Is Residential Real Estate Still a Viable Investment Now?

Dr. Joel J. Napeñas

8 minute read

I am often told that ‘The market is too hot’ and that ‘we are in a bubble.’ One cannot help but feel this way in recent environments, with multiple offers being made for residential homes on the market, at prices well above asking, and waiving of contingencies that normally protects buyers. In the commercial real estate space (which includes large multifamily real estate), we see what they call ‘Cap rate compression’ which effectively increases the earnings multiples that properties are traded and sold for.

Therefore some express hesitation to either purchase or invest in real estate, and take the strategy that they will ‘sit things out’ and ‘wait for a correction,’ in the hopes that they can then participate once prices drop to more favorable valuations. The problem for those who have taken that approach, thinking that we have been in a bubble for the last few years, is that they have missed out on significant returns for either income generation or expanding their nest egg. In addition, those who have sat in cash for the last 5 years (2016 to 2021) have effectively seen the purchasing power, and effective value of their cash erode by 13.2% due to inflation (based on the consumer price index figures). This means that $100,000 today would only buy you $86,800 worth of goods in 2016 dollars.

Historical appreciation

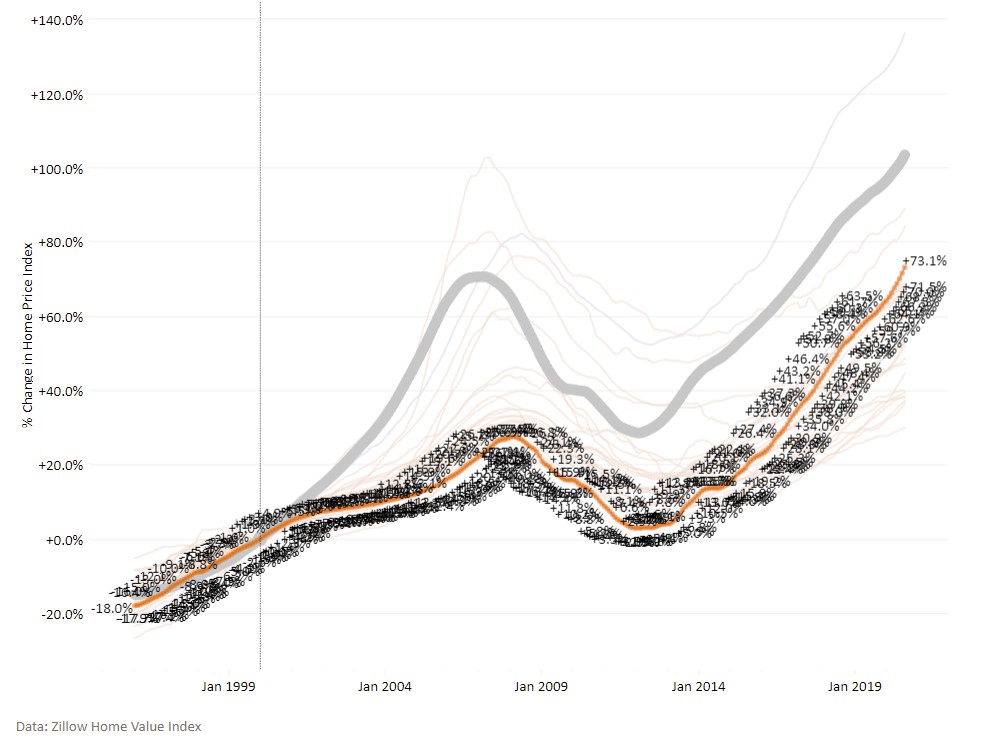

The U.S. national home price index has shown a greater than 103% rise in the values of homes nationally in the 20 years from 2000 through 2020, which averages out to a 3.63% cumulative annual increase. This included the 25% drawdown from the peak in January 2007 to the trough in February 2012, and does not include the record 13.2% increase in home prices between 2020 and 2021.

As an example, our home market of Charlotte, NC had a more modest 73.1% rise in home values between 2000 and 2020, however had a staggering 25% year over year rise between 2020 and 2021, due to the demand fueled by net migration to the area that was triggered by the pandemic allowing and encouraging more remote work situations.

Market Bubbles – The 2008 Global Financial Crisis

Those with fears of a bubble immediately look back to their experience of the 2008 global financial crisis (GFC), in which the entire financial system was almost taken down due to manic and aggressive lending practices that artificially propped up the valuations of real estate around the world. For instance, Miami, Florida experienced the most dramatic rise in valuations, with peak values in December 2006 of 169% of their year 2000 values, followed by a 52% drawdown to the trough in March of 2012. Therefore, those who bought at the peak saw the valuation of their properties decline to less than half of its value. It took more than 15 years for valuations in Miami to return to their December 2006 levels.

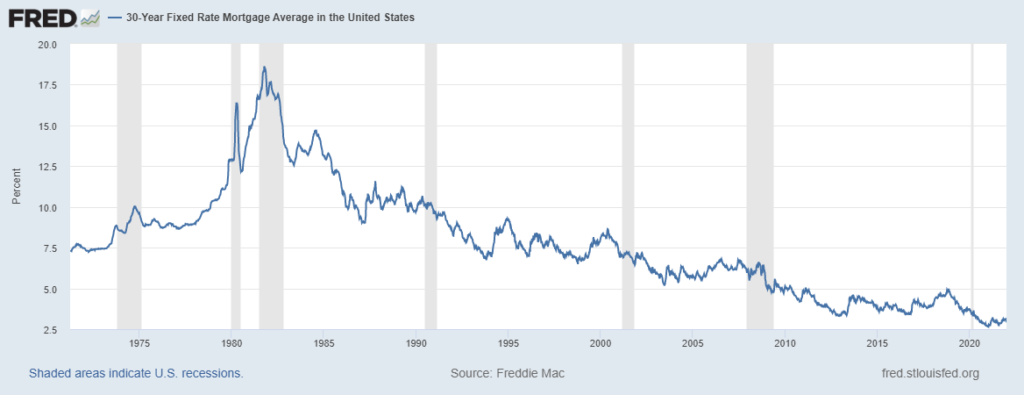

Bubbles are fueled by a number of factors that artificially prop up the valuations of assets. In the case of the 2008 GFC, it began with the Federal Reserve (a.k.a. “The Fed” or the central bank) decreasing interest rates to historical lows, in order to boost the economy by making money available to businesses and consumers at bargain rates. (This is not unlike the current situation, which has interest rates at even lower rates than prior to the GFC.) Borrowers took advantage of the low mortgage rates, and even subprime borrowers, those with poor or no credit history, were able to obtain a mortgage. The combination of these factors increased demand for homes and properties, and thus increased valuations to record highs.

Eventually, interest rates started to rise and homeownership reached a saturation point. The Fed started raising rates in June 2004, and U.S. homeownership had peaked at 69.2%, and the demand had fallen. Thus, during early 2006, home prices started to fall. Some people’s homes were worth less than what they paid for them, and they couldn’t sell their houses without owing money to their lenders.

The most vulnerable subprime borrowers were stuck with mortgages they couldn’t afford in the first place, and if they had adjustable-rate mortgages, their costs were going up as their homes’ values were going down. This led to a number of defaults on mortgages and foreclosures.

Are we in a bubble now?

So it begs the question as to whether we are currently in a bubble, given that the Fed has interest rates at historical lows less than during the GFC. While the current pace of real estate price growth will not go on forever, and prices may flatten, the current fundamentals and conditions are not present for another 2008-like crash. The main factors in the current price runup are tight supply and strong demand, both of which are likely to continue in the near future.

Demand

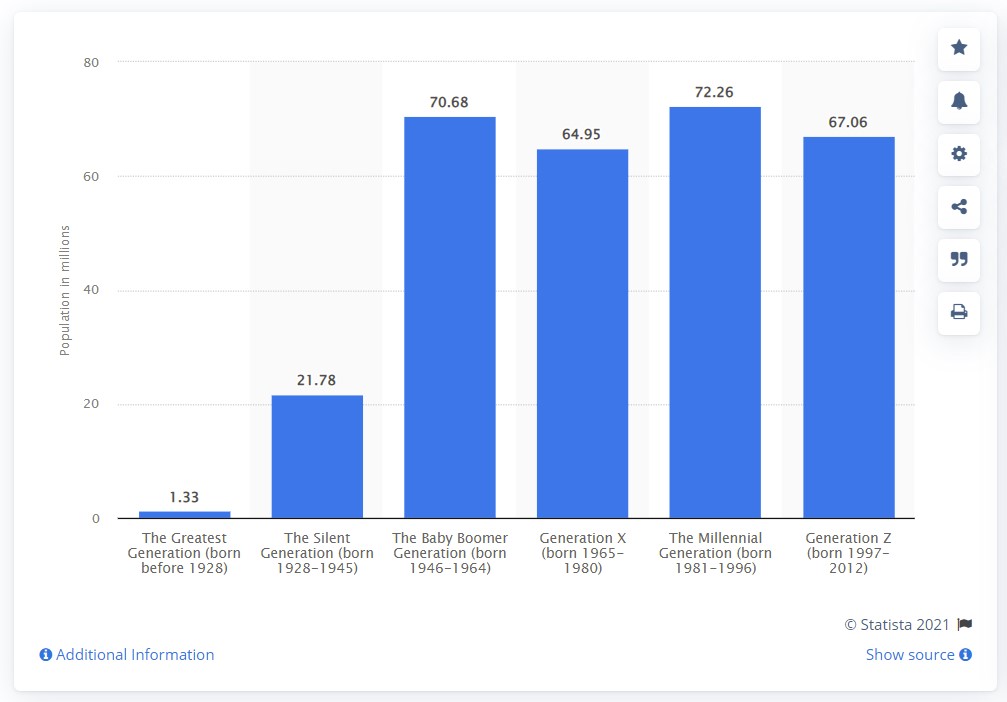

Demographics favor this, as the millennial generation is currently the largest age group, and driving demand for housing as they are in their peak productive years and seeking places to live as they form new households. Having overbuilt in the 2000s, homebuilders in response to the GFC underbuilt in the 2010s. According to the National Association of Realtors, home construction has lagged so dramatically that we’re now facing an undersupply of 6.8 million homes.

Lending practices

We are also not experiencing the loose lending practices that were seen in the mid 2000s, in which subprime borrowers were granted access to credit. It is currently much harder to get a loan, and the ones granted are smaller in proportion to property values and borrowers’ income. Borrowers’ average credit scores are higher, and documentation requirements in order to prove creditworthiness remain stringent. Thus the concern over a glut of individuals carrying mortgages that they cannot afford is less of a factor than prior to the GFC.

Interest rates and mortgages

While the Federal Reserve has recently indicated that they may have to take measures to curb inflation such as increasing interest rates, the Mortgage Bankers Association estimates that the average 30-year fixed-rate mortgage would rise a little over 1 percentage point to low to mid 4% by the end of 2022, (by comparison, the rate averaged 6.4% in 2006.) Thus, the costs of borrowing money will remain at historical lows even after anticipated increases.

In addition, only about 0.1% of mortgage loans issued in 2021 carry adjustable rates, compared with about 60% in the bubble years. Therefore, we would not see homeowners of today be priced out of their homes by rising rates. In addition, it is estimated that currently only 2.8% are underwater on their mortgages, owing more on their mortgages than the value of their property, which is in contrast to the 26% who had negative equity in late 2009. Thus, in the event that one experiences an event like a job loss, and cannot make mortgage payments, they can sell their home at a profit and avoid foreclosure. This makes the market less fragile than during the GFC.

Affordability

Rising home prices challenge affordability, and negative homebuyer sentiment might result in a decrease in demand, thus potentially affecting prices. A recent report by Goldman Sachs acknowledges the potential demand problems, however the report states that while prices have increased, property in the U.S. remains affordable relative to historical standards because of the historically low interest rates and that household incomes have remained largely intact to keep pace.

Investors are adding to the soaring home prices, as investor purchases spiked 59% in July 2021 compared to the same period in 2020, according to a report by Realtor.com. Speculation has been driven by the gains seen in real estate prices, and it has made it more difficult for buyers to gain entry into the market and purchase their first property. In addition, there is a lack of supply for starter homes for first time homebuyers.

This does favor more individuals opting for renting rather than buying. Renters are contending with rising rental costs thanks to inflation, tight housing supply and a general increase in people looking for places to rent. The current cycle of rising property valuations and corresponding rising rents do favor real estate investors. This cycle would be broken by decreased demand for housing (which the current demographics and housing shortage does negate) and/or economic conditions that impact renters’ abilities to pay for rent such as a recession or a depression. However, recent reactions and interventions by governments and central banks via fiscal policy and monetary policy, respectively, have shown that they are more apt to do what it takes to prevent or curb the effects of significant economic downturns.

Conclusions

Real estate remains a viable, and perhaps excellent investment right now. While investing in residential real estate is not without its risks, it currently provides the most favorable risk adjusted rate of returns. This is likely to go on for the next five to 10 years, with demand for homes decreasing beyond 2039 due to decreased birth rates thereby decreasing household establishment that would fuel demand for housing.

To mitigate risk, and to generate favorable returns, invest in residential real estate in markets where there are rising demand, population growth, good well paying jobs, diverse economies and continued trends for sustainable growth in prices. Investors should seek steady and reliable current and future cash flow when investing, and not rely solely on speculation on future appreciation (i.e.: rise in values) as the source of their returns.

While the recent trends of valuation and price increases will not go on forever, and there is a possibility that valuations plateau and even perhaps slightly decrease, the fundamentals are favorable for continued gains in the near future. Current conditions do not indicate that we are in for another 2008-like market crash. Current demographics, governmental and central bank policies continue to favor residential real estate as a solid investment.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.