Investing for Appreciation vs. Cash Flow

Dr. Joel J. Napeñas

8 minute read

What most of us have been conditioned to do when it comes to, what we call ‘investing’ is to follow the adage ‘Buy Low… Sell High.’ No matter what it is (e.g.: stocks, real estate, cryptocurrency, commodities, art, collectables), we try to buy something that we feel is undervalued or that we think would increase in value in the future, and hopefully there is someone else who will buy it from us in the future at a higher price.

Traditional financial planning relies solely on appreciation of your portfolio of assets, hoping that the assets appreciate enough such that you have a nest egg at the end that you are able to sell off portions of those assets at higher prices to fund your retirement. Often, the portfolio comprises of index funds, or target date mutual funds, with a basket of stocks and bonds, relying on the long term increase in value of the market, and thus the portfolio. While relying on appreciation is critical to achieving financial goals in building your portfolio and net worth, doing so as your only strategy of building wealth and future income is a very risky preposition.

Trading stocks

When I started investing in my youth, what I thought was ‘investing’ in stocks was really ‘speculation,’ which is really simply gambling. You put your money in, then hope and pray that you can sell it in the future for much more than what you paid for. I had placed some blind bets on some penny stocks (from ‘hot tips’ from a couple of classmates for what was a ‘sure thing’), a well known theater chain, and a junior mining company which all subsequently went to zero.

When it comes to stocks, many factors come into play in making these bets. First, you hope that the underlying company produces a product or service that is of value to society, that they can scale, and that it would in turn result in increased revenues and earnings that would in turn raise the value of the company, and underlying stock price. In addition, you try to handicap what the market’s future appetite for that particular stock is, and what price they would pay. This is called market sentiment. Stock prices do not necessarily correlate with the value of the company in the short term, however over a longer period of time ultimate trends of price will align with its underlying value. For instance, while market manipulation by Reddit users artificially forced the price of fledging companies like Game Stop and AMC through the roof, prices ultimately normalized to reflect their true values (as of writing, Game Stop and AMC’s stock prices are one third and one quarter, respectively, of their 2021 highs.) Navigating through this discrepancy is difficult, and an individual stock’s price may not truly reflect its value for long periods of time, either being overvalued or undervalued.

“In the Short-Run, the Market Is a Voting Booth, But in the Long-Run, the Market Is a Weighing Machine”

– Charlie Munger

Conventional Investing with a Stock and Bond Portfolio

Now overall the portfolio that I have accumulated in my working years has done very well, due to some sound financial principles followed, (e.g.: asset allocation, dollar cost averaging… and not continue to make the speculative bets that I previously did while in college undergrad and in dental school) and the luck of a market that has had historically good returns in the past 20+ years. The stock market has yielded an average 7.65% per year return since the year 2000, including the 2008 global financial crisis which saw the S&P 500 lose approximately 50% of its value. This has given healthy conditions to grow my portfolio. However, I have previously indicated that these rate of returns are unlikely to sustain themselves in the future, with Vanguard’s forecasts for 10-year returns to be much lower, ranging from 0.1% annually for U.S. growth stocks, to a high of 4.1% for U.S. value stocks.

Real Estate Appreciation and Speculation

We grew up in the Greater Toronto region, a market in which real estate prices have undergone a tremendous bull market. For instance, average sale prices of homes in the city of Toronto went from $243,255 in year 2000, to $1,095,419 in 2021, a 450% increase or 7.43% annual compounded return. (By comparison, these dwarf the rate at which median home prices have risen in the United States to 127% or a measly 1.1% annual compounded return over that same time frame.) Consequently, we have seen friends and relatives back home purchase homes and properties and seeing them skyrocket in value. We have also seen relatives who have significantly increased their net worth (and semi-retire) by serially purchasing and selling investment properties, relying on the magic of appreciation in that hot market.

While we have seen their fortunes increase that way, we personally ‘missed the Canadian party,’ having spent my entire career and lived most of the past 20+ years in the United States. (It’s like watching your friend who purchased Bitcoin at $100 a coin become a millionaire and you did not buy when the opportunity came – for reference for those non cryptocurrency connoisseurs, Bitcoin’s current prices are in the tens of thousands of dollars.)

We see people purchase personal properties with the thought that it would ‘increase in value in the future.’ Those who flip homes purchase, put capital in to force appreciation, and hope that it sells at a higher target price right away. And real estate investors may purchase properties in hot markets with high valuations and compressed cap rates, solely in the hopes that the current rates of appreciation sustain themselves and that they will sell the asset at a much higher price in the near or distant future.

The Risks of Investing for Appreciation

Whether it is purchasing stocks, or investing in real estate, having a portfolio constructed solely based on appreciation is risky for a number of reasons.

- The Crystal Ball

We cannot predict the future. All those who pitch investment products to you always indicate that past results are not predictive of future returns. However, the natural tendency is for investors to pick the stock or mutual fund that has the highest immediate past returns, or in real estate purchase a property in an area that has had the highest amount of appreciation already. You can’t just extrapolate that into the future, nor assume that that rate of return or appreciation will continue. What happens is that you will pay too much, and are at greater risk of losing your money in the process.

As for real estate investors who overpay and purchase solely on appreciation in the hopes that they will sell in the future for a profit, they are often stuck with negative cash flowing properties that are nothing but expenses to hold on to (due to mortgage, maintenance, taxes and insurance). In those cases, they are not assets in the true sense of the word (at least, as ‘Rich Dad’ Robert Kiyosaki defines it.) Rather, by taking money out of your pocket, they are liabilities. Even the home that is purchased as a flip remains a liability until it is sold.

This activity had widespread devastating effects for those who participated in this speculative mania in the years immediately preceding the 2008 global financial crisis, in which many fortunes were lost by many real estate investors. One would have seen their portfolio lose significant value, as the stock market drew down more than 50%, Real estate also went down in value in an equivalent manner in certain markets therefore those who were underwater with their mortgages (i.e.: owing more on their mortgage than the value of the home) and unable to service their mortgage payments.

- Disposition of the Asset in order to get a Return

The only way that you benefit from an investment of an asset that you are relying on appreciation of is to sell the asset. Once you sell, you no longer have something that either appreciates or cash flows and you either have to put the money in the bank (in which it is guaranteed to lose value over time due to inflation), or redeploy it into purchasing another asset which you hope increases in value in the future. Those who rely on the appreciation of their primary home to make money have the dilemma that, while it felt great that they made hundreds of thousands of dollars, they still have to find a place to live either by purchasing another home at the higher prices, or rent a place and be at risk of rising rent costs.

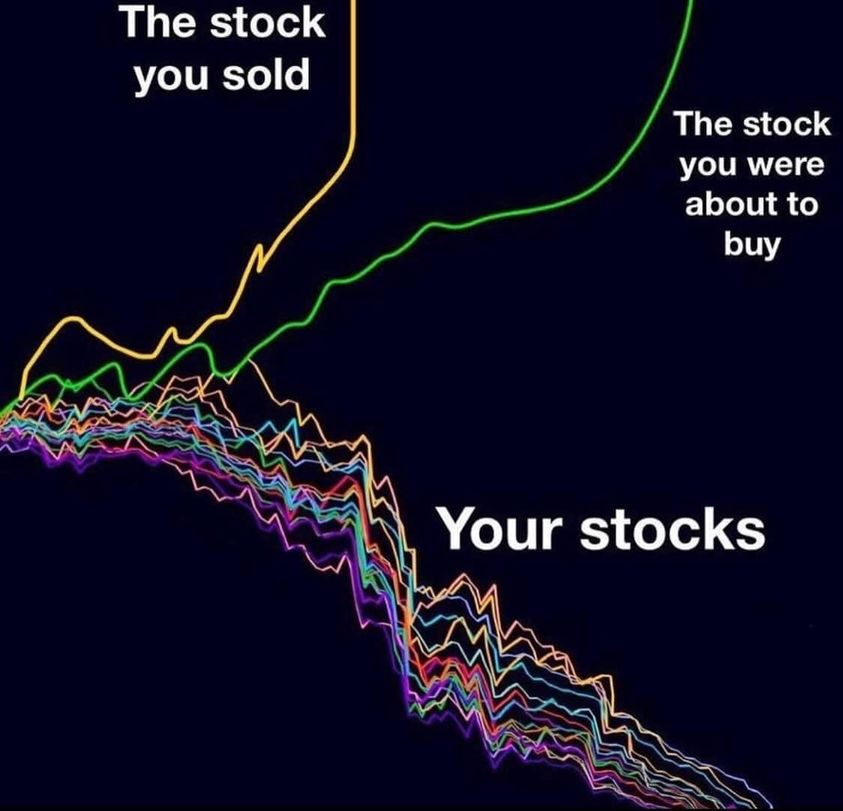

There is also the risk of selling the asset too early and not participating in subsequent appreciation. For stock traders, knowing when to sell a winner and take profits is just as (perhaps more) agonizing than knowing when to sell at a loss. Wouldn’t it be painful if you were to sell an asset too soon only to see it further rise in value significantly after you have sold it?

- Taxes

Once you sell, you would have to pay taxes on the gains as a result of the sale or trade (unless it is in a tax sheltered account). In the U.S. if the sale is made after holding the asset for less than 1 year, then it is subject to being taxed as ordinary income. The average dentist would be taxed at the 32% level, therefore for instance if they made $100,000 flipping a home, or on a stock that they held for less than 1 year, they would pay $32,000 in taxes to Uncle Sam. Those assets sold after 1 year would be taxed at the lower capital gains rate, which in the case of the average dentist would be at 15%.

- Depletion of assets in retirement

As mentioned in number 2, if you were relying on selling your assets as the only means to fund your lifestyle in retirement, then you are at risk of your nest egg being depleted in your lifetime and running out of money before you die. Depletion and selling off of assets will effectively decrease your net worth, your measurement of wealth.

Conclusions

While investing for appreciation is the foundation of investing and growing your portfolio to build wealth, solely relying on it as we have been traditionally conditioned is a risky proposition. It is even more risky when you are looking at it being the only strategy in assembling your retirement nest egg.

How Cash Flow Creates a Buffer

In the case of real estate, if you purchase a property that is cash flowing, even if there is a downturn such as 2008, it can still generate income even though the value of the underlying asset decreases due to market conditions. Theoretically, while one may be underwater in their mortgage on their property, it can still continue to make a reliable income throughout the holding period. This creates a buffer that decreases risk. Most stocks, including those that pay dividends, do not have the same behavior in a market downturn.

One must invest in and accumulate assets that generate cash flow, which in turn can either be redeployed into purchasing more cash flowing assets, or in the case of a retiree be the source of funding their lifestyle without depleting or disposing of the underlying asset.

Not doing so is not truly investing, it is ‘speculating’ or rather, ‘gambling’. And your entire future is not worth a gamble.

We at 5DH Partners invest in properties with the first priority of generating cash flow, in addition to forced and market appreciation.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.