2022 Apartment Investing Outlook

Dr. Joel J. Napeñas

3 minute read

In 2022, with increasing values, decreased cap rates, impending interest rate hikes, conflicts and inflation, IS IT TOO LATE TO INVEST in real estate?

In Brad Sumrok’s annual 2022 Apartment Investing Forecast, the answer is a resounding ‘NO.’

Here is a recap of the key takeaways and my additional comments:

- Increasing rents and values are significant factors driving inflation, therefore apartments as an investment are a hedge against inflation.

- Employment is continuing to trend upwards (further validated by last week’s announcement of the unemployment rate at a two-year low of 3.8%) supporting a robust base of renters and buyers.

- There are more people renting or buying than units available. This housing and supply shortage and shift in demographics continues to favor increased demand and therefore increased rents and valuations.

- Increasing gaps in affordability between home buying vs. renting favor more demand for renters.

- All factors combined support rent growth continuing to be high and vacancy low, which favors continued increased revenues for apartment investors.

- Gradual increases in interest rates will have a little impact since they will remain at historical lows (even after the anticipated 3-7 rate hikes in the next 18 months) and not keep pace with the anticipated increase in revenues.

- 2022 is the last year to benefit from maximum tax advantages of investing in real estate.

- There is a massive availability of capital and awareness of investing in alternative assets outside of stocks and bonds, further driving valuations up.

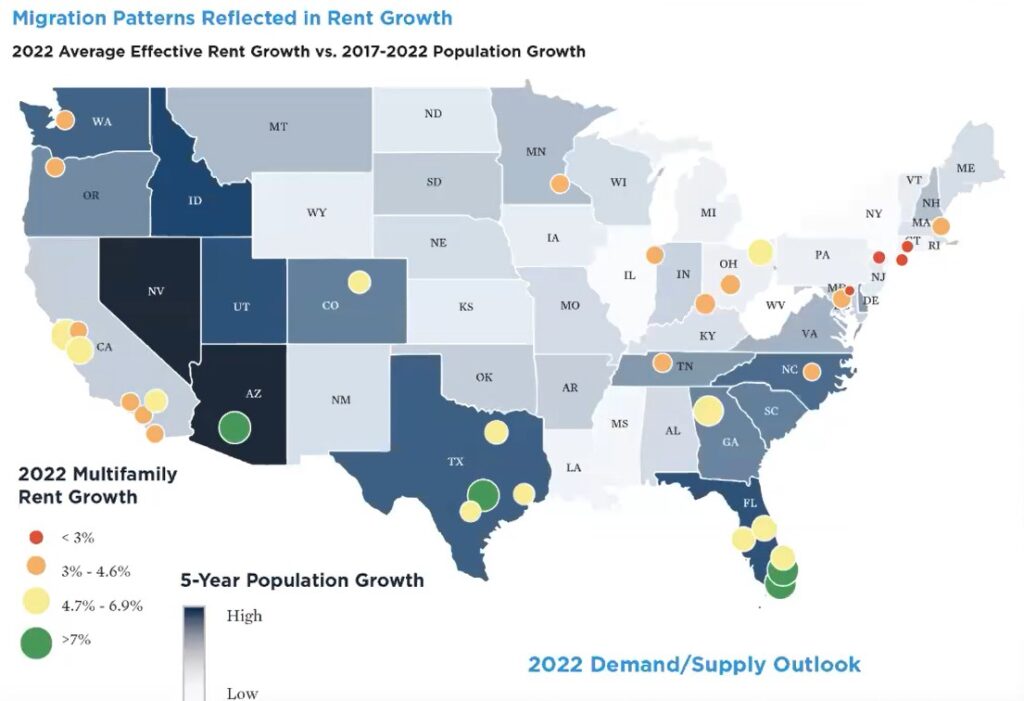

Choose to invest in markets with above average job growth, population growth and are landlord and business friendly. These include the Carolinas, Florida, Georgia, Texas, Arizona, Nevada, Colorado and Utah and Idaho.

The pandemic has proven that apartments are more resilient and outperform other classes of real estate.

Therefore sitting in cash that devalues on a daily basis waiting for the next downturn is not the way to go.

When looking at reliable cash flow, long-term growth and potential, investing in apartments in the right locations are still a great way to grow and protect your wealth.

If you have not started investing this year, it is not too late to start. And if you are already an investor, it is still a great time to add to your portfolio of assets.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.