Interest Rates, Inflation, War and Your Nest Egg

Dr. Joel J. Napeñas

4 minute read

Is the current market volatility (May 2022) making you nervous right now? Is your portfolio’s drop in value giving you pits in your stomach?

Why is this all happening right now? Is it Wars? Inflation? Interest rate hikes?

It’s all of the above. You see, stocks are valued based on a couple of key factors. First is the underlying companies’ prospects of growing and increasing their profits. Wars potentially threaten to negatively affect the economy and thus decrease companies’ earnings. Inflation makes the cost of producing things or providing services go up, also potentially impacting companies’ profits.

The main key factor is interest rates. As interest rates rise, they increase the cost of companies to borrow money to grow and operate. It also increases the costs of credit for consumers and businesses, with less money circulating to spend or deploy. Both factors negatively impact companies’ earnings.

More important is how investors’ (more so the big money players) choose to allocate their money in response to changes in interest rates.

When interest rates go down, there is less incentive for investors to put their money into ‘safer assets’ like bonds (e.g.: US treasuries) for a fixed income, especially when that income becomes such a nominal amount. As more pile their money into stocks, they drive the values of the stocks higher. (Conversely, those already holding bonds with higher yields see their values go up).

When interest rates, and conversely bond yields go up, more money is taken out of more ‘risky assets’ and placed into the ‘safer assets.’ With all of the trading and speculation going on, money managers and retail investors sell out of these assets to take profits and/or protect from further losses, even further pushing prices down. This is a big part of what is responsible for the drops in stocks (and other ‘risky assets’ like cryptocurrency) going on at the time of writing this article.

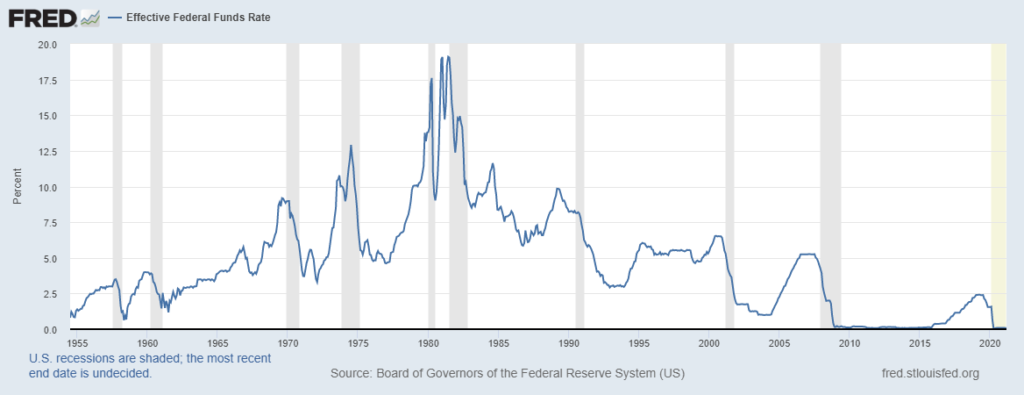

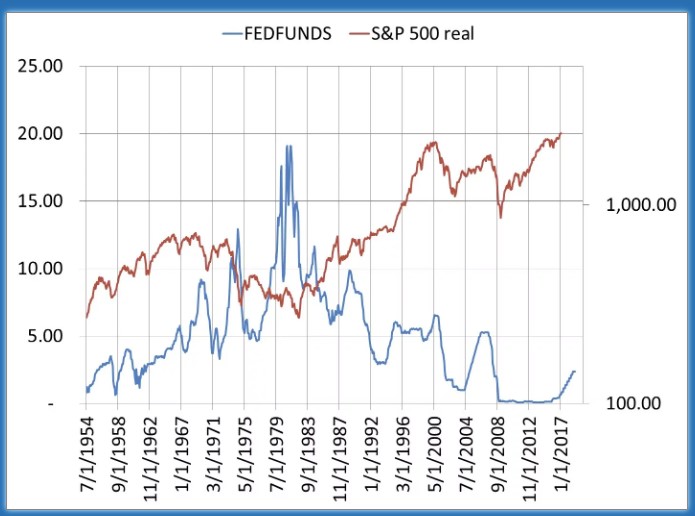

The steady decrease in interest rates over the past 40 years has been a significant driver to the steady increase in both stock and bond valuations over that time span.

So if you’ve been investing over the past 40 years solely in a traditional portfolio of stocks and bonds, you probably have done very well with both the stock and bond components increasing in value over that time.

The Problem with Traditional Financial Planning

We’ve been told by Wall Street that the best way to build your retirement nest egg is to put your money in a portfolio of stocks and bonds. Most employer based 401ks only offer these in their employees’ retirement accounts. Traditional financial planners suggest that we continue to allocate our portfolios in the same manner going forward, with the assumption that the next 30 years will mimic the last.

Here is the problem with that assumption right now. With interest rates at historical lows, and having nowhere to go but up, bond yields are never going to generate the income that they have in the past, and their valuations have nowhere to go but flat or down over the long term. Stocks, still at historically high values on a price to earnings basis, are not going to experience the same increases as they have in the past with interest rates at their current historical lows. I have previously indicated that Vanguard’s forecasts for 10-year returns for U.S. stocks are much lower than before, projecting only a 3.3% annual return.

Therefore, if you are following what most financial planners (and Wall Street) are telling you to do, by allocating all of your nest egg simply in a basket of stocks and bonds, you are not going to get the same returns as the previous generation. It will not grow your nest egg big enough to safely retire out of the rat race.

Don’t do solely what the traditional financial planning has conditioned us to do.

Look at incorporating alternative assets into your portfolio.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.