Early career colleague mulls buying vs. renting.

Is Buying a Home Now a Good Decision?

I was approached by an early career colleague about whether it was a good idea to buy a home now. They had been renting for a number of years, and were looking to settle down with a significant other. For most, their home is perhaps their largest expense, but also the largest component of their net worth.

The colleague’s question can really be further broken down into 2 fundamental questions:

- Is now a good time to buy?

- Is buying now the right financial decision for me?

Is Now A Good time to Buy?

This further breaks down into the questions of:

- Could I wait for home prices to go down, or if I don’t buy now will I miss out?

- Should I wait for interest rates to go down to get a mortgage?

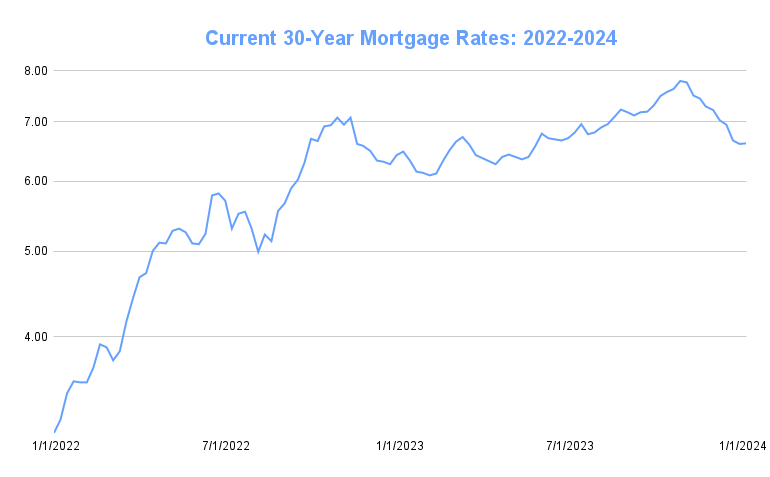

Despite rising interest rates, home prices have not gone down in the past year. Last year, home prices went up 3-6% nationally all the while mortgage rates went up to as high as 8% from the sub 3 levels only a couple of years prior.

This was because supply decrease outpaced the demand decrease. Those who have mortgages locked in at sub 4 levels (including yours’ truly) would not want to give those up, thus there were relatively few homes on the market. While demand has cooled, it still remains due to the millennial generation, the largest by population, approaching their peak earning and family forming years (like the young colleague looking to buy).

It is anticipated by some experts that this year, home prices will continue to go up, with an estimation of 4-7%. That is because there will be a slow down of new construction of homes, the costs of construction are increasing thereby increasing the asking prices of newly built homes, and there will not be a lot of foreclosures because, unlike in 2008, people have better credit and decent equity in their homes (i.e.: are not ‘underwater’) due to the home price appreciation.

The second factor is interest rates. Will the Federal Reserve increase or decrease them? And if they decrease them, when? While markets at the end of last year were anticipating a decrease early this year, it does not look like it will be the case because of higher than target inflation and continued low unemployment rates.

If interest rates decrease, expect a corresponding increase in home prices. One estimation is that, for every 1% decrease in interest rates there will be 5 million more homebuyers in the market. Yet, interest rates will not go down to the historical lows of just a few years ago (unless we go into a deep recession). Thus I anticipate people (like me) still wanting to hold on to their current home mortgage, relatively low number of homes up for sale, and thus supply not meeting the demand. This will further increase home prices.

So if you’re looking for decrease in home prices due to some market correction, don’t bank on it. Also if you’re holding out for lower interest rates so that your mortgage payments will be less, don’t bank on that either. And even if interest rates were to fall, it will correspond to an even greater increase in home prices from where they are now.

In the end, it all boils down to the second fundamental question… Is Now a Good Time for ME to buy? It is all about the costs of homeownership, and how it fits into your own personal financial situation.

I will tackle that one in the next post.

If you want to talk about how you can build and preserve wealth and generate passive income like the ultra-rich, set up a time to talk with me

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Subscribe to our email newsletter here.

Visit our Facebook and LinkedIn pages, or join our newsletter mailing list for articles, updates, and opportunities.