How Inflation is Robbing You of Your Financial Freedom

Dr. Joel J. Napeñas

10 minute read

At the time of this writing (early 2022), inflation had become a mainstream buzzword. Was it ‘transitory’ (i.e.: temporary) or was it permanent? Personally, I feel it in my wallet when I either order takeout or make a trip to the grocery store to feed my family of five, which includes three growing children with very healthy appetites. For example, to order Chinese food takeout recently, I found myself paying over $65 (including tip) just for an order that included one fried rice dish and two noodle dishes. For a 2 liter carton of milk (though Winnie insists on getting the ‘brand name’ organic variety), we are paying as high as $5.50. These prices seem unheard of as of a few years ago, in which each of these items were priced at half that amount.

Inflation is more apparent with the big ticket items:

- Health Care – Out of pocket health care costs, on a per capita basis in the US, have more than doubled in the last 20 years.

- Housing – Median home prices in the US have risen from $212,000 on 1/1/00 to $342,845 on 8/1/21, a 62% increase

- Education – Average college tuition has gone from $10,820 in the year 2000 to $24,623 in 2019, a more than 128% increase in less than 20 years!

The Consumer Price Index – A measure of inflation

The consumer price index (CPI), an inflation gauge in the United States that measures costs across dozens of items, rose 7% in December of 2021 from a year earlier, the fastest pace since June 1982. This means that your dollar now only goes as far as 93 cents worth of items or expenses from the previous year.

The CPI examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living.

Some, such as famed hedge fund manager, Bill Ackman, say that the CPI actually underestimates true inflation rates, due to an inaccurate estimate of the cost of housing, one of the key metrics and which is most individuals’ largest expense. For the CPI, housing cost data is obtained through market surveys of homeowners, and not via a compilation of the true data. The owners’ equivalent rent in December 2021’s reported core CPI was 3.5% year-over-year, whereas the largest owners of nationwide single family rentals were reporting 17% year-over-year rent increases. If one were to factor in the latter metric into the CPI’s formula, they would end up with a closer to 10% year over year increase in 2021. This means, for every $1000 that you have in the bank, it’s purchasing power is only good for $900 worth of last year’s goods.

Using my own example in my W-2 job in which I have a fixed base salary with bonuses, some years (like this one) I get a pay raise of 2% of my base salary, whereas other years I get no pay increase. Therefore using the past year, essentially I am at a 8% income decrease in real terms (when factoring in inflation) from the previous year (yikes!).

And don’t expect for this to reverse the other way! While a few individual items may go down in price over time (e.g.: technological items such as televisions), once overall costs of living go up, it is not expected to return the other way. Meaning, unless your salary or your money stashed away keeps up with the pace of inflation, your income and savings are running at a net loss!

What Causes Inflation?

Inflation results from an increase in production costs or an increase in demand for products and services. Production costs increase either due to increased costs of the materials to produce them, or increased wages in the workers to deliver the goods or services. Increased demand occurs when there is more money in the system either in the hands of consumers in a good economy, or credit is available to consumers or institutions, to be able to drive prices of goods and services up. Conversely, this can also drive the prices of assets (e.g.: stocks, real estate, and cryptocurrencies) up.

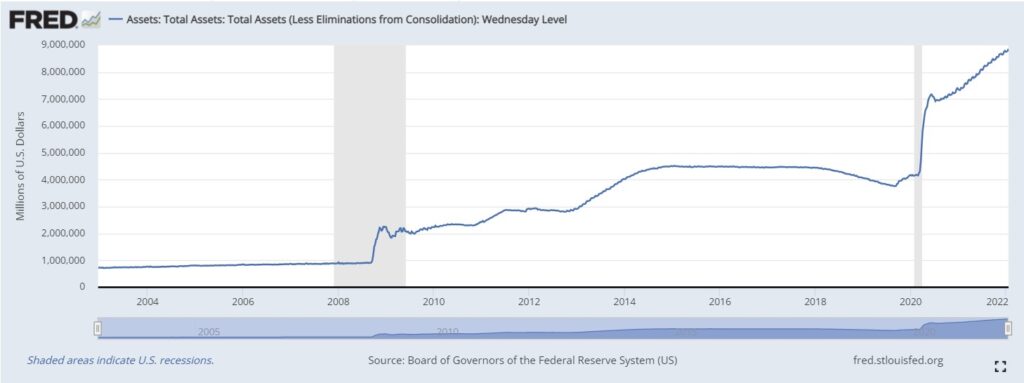

You may have heard the term ‘printing money’ by the Federal Reserve (‘the Fed’ or central bank). They really do not ‘print money’ per se, but rather they expand credit to the banks, who in turn are able to make money available through credit to individuals and institutions to borrow, spend and/or invest, increasing the money supply in circulation in the economy. Since the onset of the COVID-19 pandemic in March of 2020, the Fed’s balance sheet has risen by a staggering $4.6 trillion dollars, essentially increasing the money supply in the U.S. by that amount, which equates to more than one fifth of the current US gross domestic product (i.e.: all of the goods and services activity for the year). When coupled with the cost of borrowing money being at record lows, there is much incentive to use and deploy this available credit. This substantial increase of money in the system inevitably drives inflation, increasing the prices of goods, services and assets (such as stocks and real estate), and accounts for the recent spike in CPI in the past year.

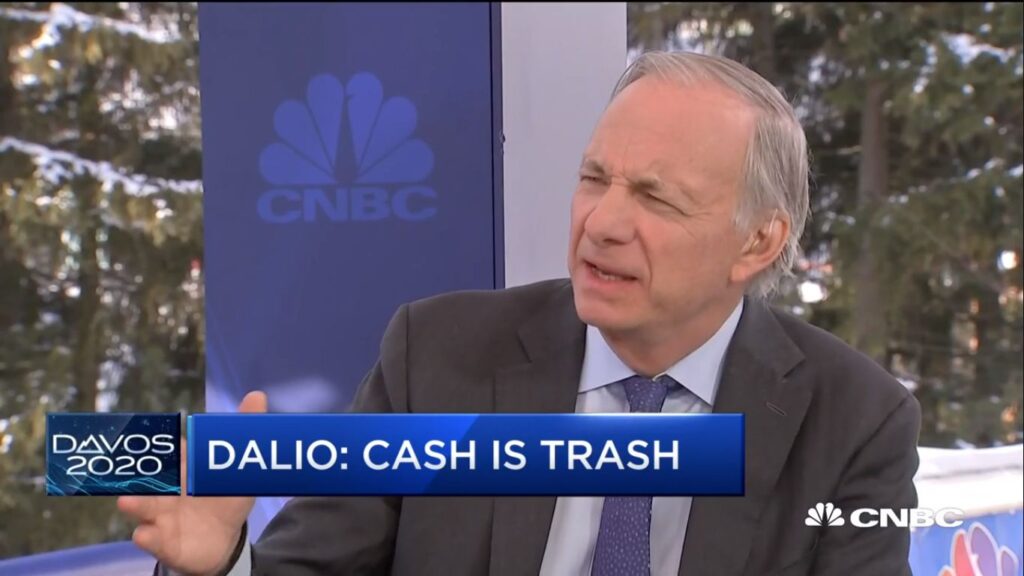

“Cash Is Trash”

It is because of inflation that Ray Dalio, the legendary billionaire founder of the world’s largest hedge fund, coined the phrase “Cash Is Trash.” At the moment, money saved in the bank (or stuffed under a mattress) essentially has a 0% rate of return in interest. The value of your money sitting in a savings account in 2021, has essentially lost 10%! Now wouldn’t you panic (and call your financial advisor or broker) if you looked at your retirement or brokerage account balance and saw that it went down 10% for the year?

Now 2021 was an extraordinary year for a number of reasons, and we don’t expect inflation to be at that rate every year. Since the year 2000 (about 22 years), cost of living has risen 61.9% which translates to an average annual inflation rate of 2.5%. However those last 20 years were marked by historically low inflation rates, and all signs point to higher rates in the near future. Therefore a more fair assumption is to use a 50 year time span (1971-2021), which includes both the more recent era of low inflation, combined with the high inflation years of the 1970s. The last 50 years had an average annual inflation rate of 3.93%. With the current monetary policy practices by the Fed, we are more likely headed to a rate closer to this number in the foreseeable future.

How Inflation Eats into Your Retirement

About 15 years ago, our financial advisor once said that we would need to accumulate a minimum of $2 million dollars at retirement age. At the time, that sounded like a lofty and perhaps unattainable goal. That seemed to be the standard target number floated.

Most financial planners, when planning for retirement, use the 4% rule. The rule says that one withdraws 4% of the total amount of their retirement savings (i.e.: their ‘nest egg’) in order to yield a consistent stream of annual income, enough to cover living expenses. The rule is meant to give seniors a high degree of comfort that their funds will last over a 30-year retirement. It also assumes that the portfolio comprises a combination of stocks and bonds that continue to generate the same historical returns. With the current record high valuations of stocks, and record low interest rates for bonds, it is unlikely that returns will be the same as previous years. Because of that, a recent report by Morningstar recommends a 3.3% withdrawal rate in retirement.

So let’s use the example of a $3 million nest egg to retire at age 65. If you were an early career dentist starting at age 27, retirement would be 38 years away. So you think that you may have more runway to build up that nest egg, however the more runway you have, the more opportunity for inflation to eat into those gains.

Using the 3.3% rule, your $2 million dollar nest egg would yield an annual income of $99,000. Using the 3.93% historical annual inflation rate, in 38 years, that $99,000 would only have the purchasing power of $22,881 in today’s dollars! (By comparison, $21,960 is considered the poverty line for a family of 3) This yet does not factor in income taxes! Therefore, inflation has essentially reduced your real income from a $3 million nest egg to that just above the poverty line!

What are the ways to remedy this? One way is you can violate the 3.3% or 4% rule and draw more funds in retirement from the nest egg, however that increases the chances that you will run out of money in your lifetime. Another way is that you can aim to accumulate a larger nest egg and hope that you don’t have ‘too much life for your money.’ Using the example dentist above, for them to have the equivalent of a (very modest) $100,000 in today’s dollars of annual income (which translates to $432,668 after factoring inflation), they would have to have a staggering $13 million nest egg. Using an optimistic 5% annual return in a portfolio of stocks and bonds, they would have to save $120,000 annually for the next 38 years! As we have established in previous posts, this is essentially the entirety of the mean dentists’ take home earnings after taxes and Social Security.

Take Home

What does this tell you? Traditional financial planning, when you factor in inflation, just does not work! Instead of building up a nest egg that you draw down and hope doesn’t run out before you die, you need to have a portfolio of assets that generate passive income to support your lifestyle, keep pace with inflation by growing in income and appreciating in value, and are tax efficient.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.