It’s Not Enough Just to Earn, It’s Also What You Burn

There are a lot of folks out there that earn a lot of money, such as our dentist and physician colleagues.

They may earn a lot, but they are not rich. (refer to Why Dentists Don’t Get Rich)

At the beginning of their career, things are new and novel, and they feel like they’ve got the energy and drive to keep doing this forever. The bigger paychecks come in, and they feel wealthy. And as they feel wealthier, they spend more.

They then give the appearance of being rich, with the ‘doctor house’, Teslas, kids in the best private schools and fancy vacations that they are posting on Instagram. But in order to do so they take on more liabilities such as car loans, mortgages and credit card debt. As their earnings from their job go up, so does their ‘burn rate.’ As people age and their families grow, their burn rate goes up via a phenomenon that we call ‘lifestyle creep.’

We certainly felt that way the last time we had a significant income bump from my job. While we never were the types to live an extravagant lifestyle, we initially took more liberties in our spending.

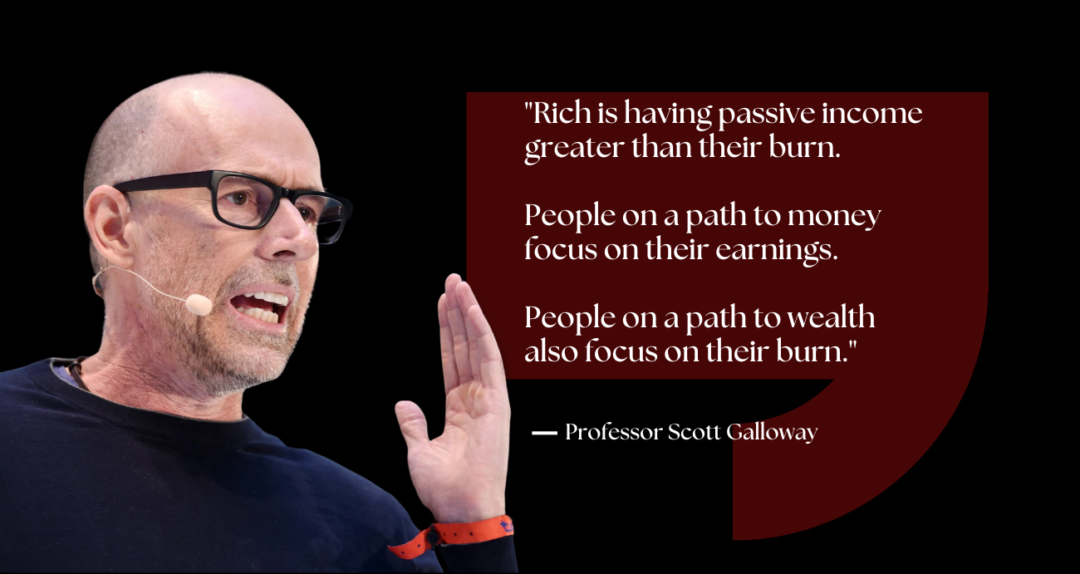

The focus for most is on earning more. But once they earn more, they spend more and increase their burn rate. And once their burn rate goes up, there is no going backwards.

And in order to keep up with that burn rate, they realize that they are stuck spending most of their waking hours in their job and practice, obligated to do so with no immediate end in sight.

Here’s the thing. Most people’s earnings are not keeping up with inflation. We’ve previously established that with physicians, dentists and lawyers. So even without lifestyle creep, their earnings from their work are not keeping pace, while being pressured to go up even further to keep up with the increasing obligations from their lifestyle.

I’ve realized mid career and mid life, that the steps to true wealth are as follows:

- Earn as much as you can from your time, energy and efforts.

- Determine what your burn rate is to meet obligations and live comfortably, and keep it there.

- Instead of using your increased earnings to increase your burn rate, funnel the extra earnings into accumulating assets that will generate passive income.

- Grow the portfolio of assets and grow the passive income without having to sell the principal.

- Once your passive income increases and approaches your burn rate, only then you can increase your burn rate (and perhaps live a little more luxuriously).

(refer to What Is True Financial Freedom and Why is Financial Literacy So Important to Get There)

I’m not saying that being rich means stopping work altogether (though it is your choice if that’s what you want to do). In fact, the wealthiest people in the world are perhaps the hardest workers in their chosen businesses or vocation. But they’re doing it on their own terms. And once you’re doing things on your own terms, you make a greater impact and contribution to those you serve, whether it is your family, patients, clients, community or humanity.

Being rich means no longer spending your time doing things you have to do. It’s doing the things that you want to do.

If you want to talk about how you can build and preserve wealth and generate passive income like the ultra-rich, set up a time to talk with me

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Join our Mailing List here: Subscribe

Visit our Facebook and LinkedIn pages, or join our newsletter mailing list for articles, updates, and opportunities.