Knowing Projected Returns is Not Enough

Looking for the Perfect ‘Fat Pitch’

A friend was presented with an opportunity to invest in a fund that was developing self-storage properties. The minimum investment was a substantial amount, in the mid-six figures. I had a look at the offering memorandum, and it highlighted what the projects are, where they are, the potential for growth and success in those markets, and the projected returns. And the projections were excellent, with substantial target revenues, a 25-27% annual return, and a 270% total return on investment.

Similarly, an associate in a dental practice that was recently bought out by a group, was offered to purchase shares of the group, which also had a substantial minimum amount. The offering materials simply gave some history of the organization, how many practices they owned, and what they were projecting to pay their shareholders in years 5 and 10 (with money locked in with them until then). However, when I recommended that they get more information about the group’s business plan outlining exactly how they were going to achieve these projected returns, they were told that the information was ‘confidential.’

It is great that there are now a variety of alternative private equity investments to allocate your hard-earned money in. And they all are promising lofty returns. So how do you choose where to allocate a significant portion of your money in, knowing that it is locked up for a period of time (in the case of the deal pitched to my friend, up to 11 years)?

Either you have absolute trust and faith in the main operators of the asset you are investing in, or you have an understanding of the investment. The prudent investor ideally should have both. Whether you are investing in a publicly traded stock in a company, shares in a private business, or in real estate, you are investing in a business that you hope will:

- generate income (i.e.: make money) and / or

- increase in value (usually from increasing its income)

Thus, it is your responsibility as a potential investor to ask those running the investment to explain to you exactly how they plan to achieve these two things. You then have to assess whether:

- It is realistically achievable and

- whether their assumptions make sense

After that, you have to determine whether you believe that the leadership team of general partners, sponsors, and operators will be able to deliver. (We previously touched upon this here.)

Can they, and have they done so in the past? Most are ethical and competent and are working with their investors and clients’ best interests at heart. But just because they are a great speaker on stage, or are very personable when you meet them, it doesn’t necessarily mean that they can or will deliver.

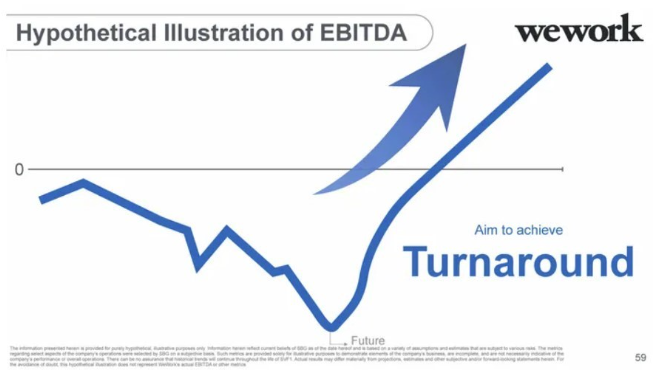

“Pie in the sky” projections – Actual pitch deck for WeWork which ultimately failed, which investor SoftBank lost $4.6 billion on.

It isn’t good enough just to believe that investing your money with them will generate a return. They all will project lofty returns. Some will achieve and even exceed these returns. Others will not, and in the case of WeWork, a company that could never generate a profit, will lose all of their investors’ money. You need to know exactly HOW they plan to generate those returns.

In the case of the dental practice group, the company’s lack of transparency was a red flag, and ultimately the associate did not invest. Is it possible that they missed out on a great opportunity? Maybe.

But as Warren Buffett says, investing is not like baseball in which you only have 3 strikes to swing at. There will be many other pitches coming your way. You can patiently wait for the perfect ‘fat pitch’ to ‘hit that grand slam’.

If you want to talk about how you can build and preserve wealth and generate passive income like the ultra-rich, set up a time to talk with me

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Subscribe to our email newsletter here.

Visit our Facebook and LinkedIn pages, or join our newsletter mailing list for articles, updates, and opportunities.