The Third Leg of Real Estate Investing – ‘Location, Location, Location

We continue our series on the 4 legs of real estate investing, zooming in on the actual property factors. One can select an excellent market to invest in as established in the last post, but can still fail miserably if they do not zoom in and look at the local and inherent factors affecting the property themselves. In this article, we will focus on one aspect, the location of the property and the demographics.

The saying goes, ‘Location, Location, Location.’ This is the most well-known of factors. The location of a multifamily property is essential because it determines its potential demand, rental income, and thus value.

We intuitively know that you want to invest in a property in a desirable location with good infrastructure and access to transportation, amenities, and job opportunities nearby. Areas with low crime rates, good schools, and healthcare facilities are more attractive to tenants, which can lead to higher occupancy rates and rental prices. However, while these subjective factors are important, what are the most critical objective measures to use?

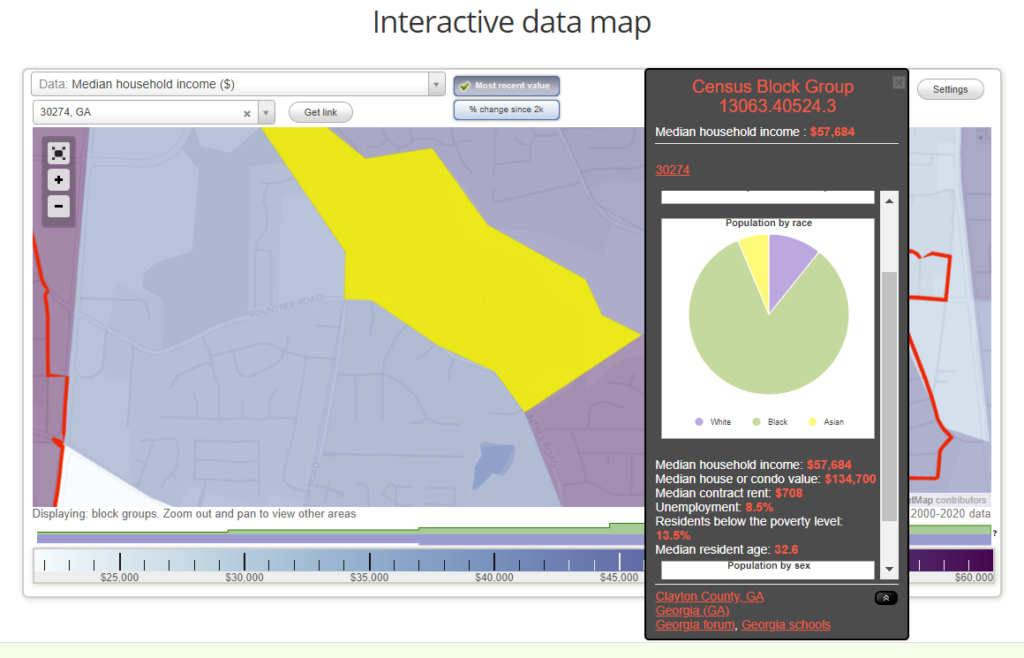

Example neighborhood search on www.city-data.com

In our initial analyses of all properties, we follow real estate investor Neal Bawa’s specific data-driven strategy in analyzing neighborhoods. We do so by identifying the exact city block that the property is located on the website www.city-data.com, where you can scroll down and find the ‘Interactive data map’ and type in the zip code. Once you locate the exact block of your prospective property, you can find the following information:

Median household income

Can your tenant base afford to pay the proposed rent? Ideally, you want the median annual income to be $40,000 and above. You also want to determine what the current and potential market rent is in that neighborhood for similar rental properties. Median rents are found on city-data.com, but you can get more current market rents on sites such as www.rentometer.com, Zillow, and www.apartments.com. One rule of thumb is to take the monthly rent, multiply it by 3 times, then annualize it by multiplying it by 12. You want your median annual income to be greater than this number.

Target Median Household Income = greater than 3 X Potential monthly rents X 12 months

Unemployment rate

You want the unemployment rate for that block to be less than 2% more than the unemployment rate of that city. So for example, if the unemployment rate in Charlotte, NC is 3.6% (as of the time of this writing), you want the unemployment rate of that block to be no more than 5.6%.

Poverty level

This ideally needs to be less than 15%. It goes without saying that the lower the income level and the more that are below the poverty level, there are more delinquencies, turnover, and evictions, which significantly affect the bottom line.

Factors to consider

There are some caveats to this. For instance, the area of the property may be in transition, therefore the property in question may not meet these thresholds. Thus, you want to look at adjacent or nearby blocks for these same metrics.

You can also look at similar nearby properties to determine what they are renting out for. When we say ‘similar,’ you want to compare a 1980s-built property with other 1980s-built ones nearby, and not the newly built one next door. If you find a similar property that is charging higher rents than the prospective one, you may be able to make improvements and attract higher-paying tenants with higher median income. Thus if your prospective property is in a ‘path of progress’ area, then there are opportunities to add value and force appreciation by improving it and raising rents.

Conclusions

What Neal Bawa found was that by honing in on these key metrics, the other subjective factors mentioned above (e.g.: access to jobs, good schools, close to amenities, crime) are generally taken care of.

While real estate investing is not without its risks, you can minimize risk and identify opportunities to increase income and the value of your investment by looking at the right metrics.

If you want to talk about how you can build and preserve wealth and generate passive income like the ultra-rich, set up a time to talk with me

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Subscribe to our email newsletter here.

Visit our Facebook and LinkedIn pages, or join our newsletter mailing list for articles, updates, and opportunities.