Using Retirement Funds to Invest in Real Estate and Alternative Assets

I was once out for drinks with a colleague and we were talking about types of retirement accounts. He told me that one of his patients is his financial advisor and that he had set him up for a ‘more flexible’ type of retirement account. When I asked him what he meant by ‘more flexible,’ he replied that instead of only having the option to invest in Fidelity Mutual Funds, the account allows him to invest in other types of Mutual Funds offered by Vanguard, Black Rock, and others.

That is not a definition of ‘more flexible,’ as there is probably not much difference between a Fidelity mutual fund versus a Vanguard mutual fund, as they both have different combinations of the same things. If this past year is any indication, regardless of what type of mutual fund you have, you probably experienced the same degree of loss in your portfolio value.

Mainstream media, most financial advisors and Wall Street wants us to believe that the only investments allowed or feasible inside a retirement account are stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These are all types of publicly traded ‘paper assets.’ Most employers’ retirement account platforms only allow for these types of investments.

However, most people do not know that you can invest in other alternative asset types in a retirement account. The most notable example of this is when tech mogul and Pay Pal founder Peter Thiel was able to grow a $5 billion portfolio inside a Roth IRA by investing in a startup.

Retail and Employer-Sponsored Retirement Account Platforms are Limited

My employer, a large healthcare system, by default enrolls you in a target date mutual fund, which is a portfolio allocation of stocks, bonds, and cash equivalents, with the portfolio allocation being based on your age. The younger you are, the more heavily weighted it is in stocks. As you approach the target date, the portfolio gets adjusted to a higher allocation of bonds for less volatility. For most average investors, this is probably the best and safest option.

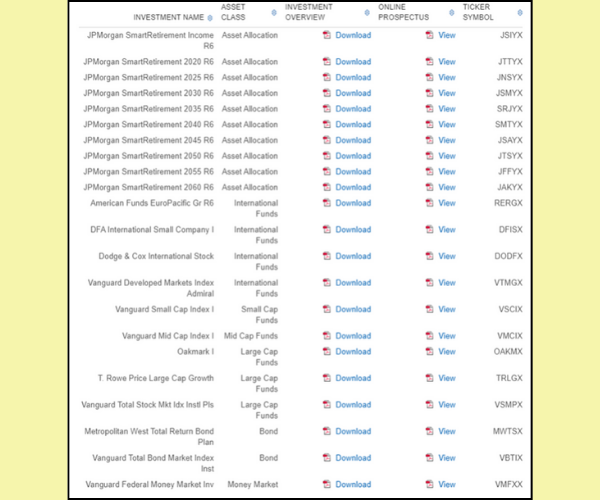

Typical employer-sponsored or retail retirement account platforms allow for only a few other options if you do not want to go with the default investment. First, they have a basket of other mutual funds which you can choose from. They can vary from different target date funds, growth stocks, value stocks, domestic and international stocks, bonds and money market funds.

Typical Mutual Fund offerings of an employer-sponsored retirement plan

My employer’s platform does allow the option for more savvy investors to have a brokerage account, which allows you to choose individual stocks, ETFs, and mutual funds outside of the basket given, but this is not the case for most.

However, with all of these different options, you are still limited to investing in publicly traded offerings from Wall Street.

What is Allowed inside an IRA or 401k?

Contrary to what most believe, in addition to stocks, bonds, mutual funds, and ETFs almost any type of investment is permissible inside an IRA or 401k:

- Real estate

- Annuities

- Promissory notes (e.g.: you are the bank lending out the money in exchange for interest payments)

- Unit investment trusts (UITs)

- Limited Partnerships (e.g.: shares in private equities such as startup companies, oil, and gas, or real estate syndications)

- Cryptocurrency

- Precious metals such as gold

There is a list of things that are not permissible such as:

- Life insurance

- Collectables

- S corporations

- Allowed assets that directly benefit or involve ‘disqualified persons’ (e.g. you, family members) – for example real estate that you or a family member personally use

Self-directed IRAs and Solo 401ks

So how are you able to invest in other things outside of Wall Street? You can do so by opening a Self Directed Individual Retirement Account (IRA) or a solo 401k. You can do so for both tax-deferred and Roth (after-tax, grows tax-free) options.

In order to open an SDIRA, you will have to establish it with a qualified trustee or custodian, as there are a number of different providers available.

If you own a business and are self-employed, a solo 401(k) plan is the same as an employer-sponsored plan. However, in this case, you are the employer and the only member of the plan. The only other person you can add to the plan is your spouse.

Once you’ve established one of these accounts, you can transfer or rollover qualified (or vested) funds from other retirement accounts into these ones.

Once you have these established, you are ready to invest your money into alternative investments that will provide diversity and help grow your nest egg.

Specific tactics on how to establish these types of accounts or how exactly to invest in one of these accounts are beyond the scope of this initial article (and perhaps the subject of a future article).

Conclusions

Contrary to what the mainstream media and Wall Street leads you to believe, you also do not have to be ultra-wealthy like Peter Thiel to invest like them (See my article on How the Ultra Rich Invest).

You are not limited to investing in stocks, bonds, and mutual funds inside your retirement accounts. As the general stock market declines of 2022 have illustrated, a diversified portfolio of publicly traded assets is not truly diverse. You need to position yourself and include alternative assets like real estate in your portfolio.

Do you want to learn more about how you can passively invest in real estate syndications inside your retirement accounts? Set up a time to talk with us

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Subscribe to our email newsletter here.

Visit our Facebook and LinkedIn pages, or join our newsletter mailing list for articles, updates, and opportunities.