Your Home Is Not an Asset

Dr. Joel J. Napeñas

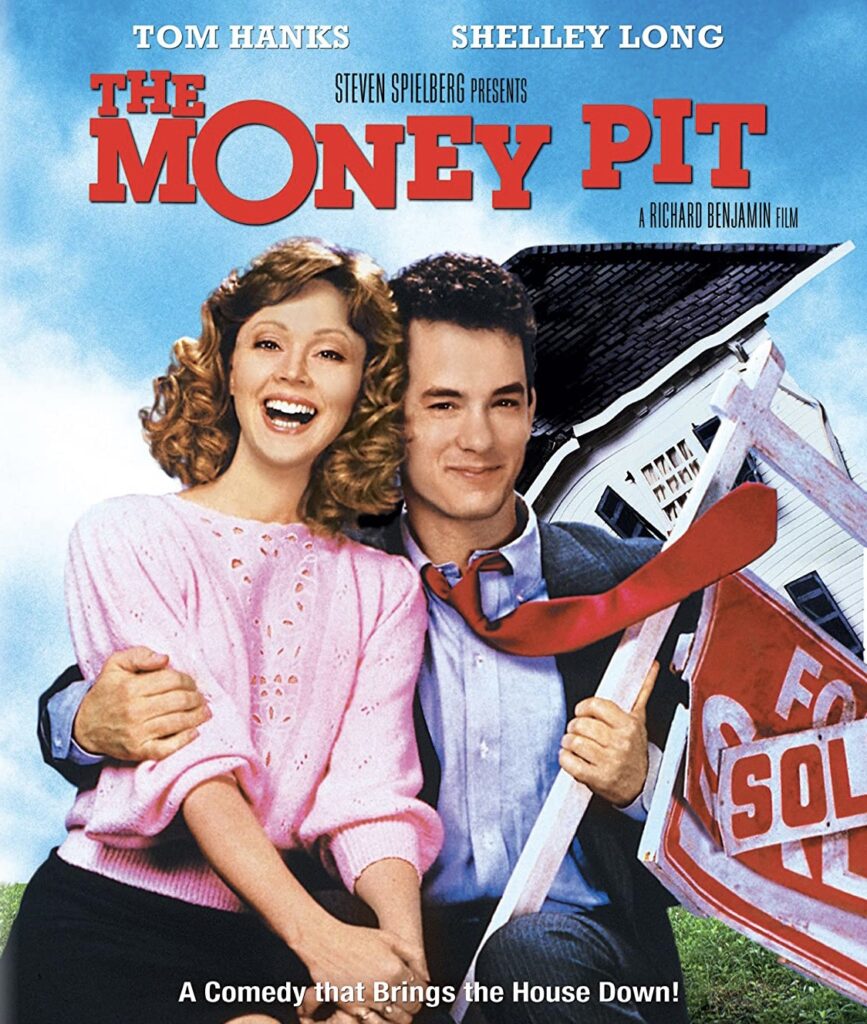

Over the past couple of weeks we had a couple of issues come up with our home. First we had a backup that, fortunately only resulted in a little bit of (but still utterly gross) sewage into one of our ground floor bathrooms. Upon calling the plumber, they found that one of the main lines exiting our home had been cracked (due to the ground settling in this 15 year old subdivision), and penetrated by roots from one of the trees outside. That repair cost us north of $5000.

A few days later, we noticed some leakage of water in our garage, which we traced back to our hot water heater which sits in the garage. The same plumbing company that replaced our main sewer line came and found that the hot water heater (which was only about 12 years old, the age of the house) needed to be replaced as it was leaking water and was a potential electrical hazard. Another $1500 expense (though they gave us a good deal as these are usually north of $2000…. Guess he felt bad having just done the sewer line job just days earlier so he cut us a break.)

Similarly, we had a recent sewer issue at one of our investment properties in Tampa, which cost us about $2000 to repair. While we were not happy about that expense, we were less disturbed in that case. Why? We have tenants whose steady stream of rent payments do foot the bill for that repair, and we still come out making a profit owning that property. Despite that capital expense, that property puts money into our pocket on a monthly basis. On the other hand, who foots the bill for our home? Us and us alone.

We have been taught (and I have been lectured by a real estate agent patient of mine) that your home is the ‘best investment that you will ever make.’ For the average person, it is the largest expense, and the largest component of their net worth. So they say that it is an asset. But as long as you own it, it is taking money out of your pocket on a regular basis.

Therefore if it is something that you must have, and continues to take money out of your pocket, it is not an asset, it is a liability.

But they say that you are building equity when you pay the principal on your mortgage? True. Yes it is cool seeing that our home has gone up several hundred thousand dollars in value since we bought it. However that equity is doing nothing for us, until we sell the home. Some rely on their home as the main way of funding their retirement. Yet, you would only benefit from the returns if you were to sell it, but then if you did sell it, where would you live next? Either downsize, move somewhere else where it is cheaper, or rent.

Now you could cash out refinance it or take out a home equity line of credit, but all that will do is increase your mortgage payments and thus increase the cash out of your pocket on a monthly basis, making it a bigger liability.

Am I saying not to buy your home? No. However pouring all or a significant portion of your disposable income into a liability thinking that it is ‘an investment’ is not a good idea either.

Invest in assets that put money into your pocket, not take it away.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.