Why Multifamily Real Estate is a Good Investment During Inflation

Dr. Joel J. Napeñas

4 minute read

When I was a kid, I opened up my first savings bank account at the Royal Bank of Canada, and was given my first bank book. It served as a ledger showing the individual transactions including deposits and withdrawals, and the balance of my account. Whatever birthday money or allowance I received for doing chores was deposited into that account, and the balance in the bank book went up. Occasionally, I would see a tiny amount of money deposited into the account which was interest paid by the bank. Seeing that balance rise felt good. To this day, many years later (mostly for sentimental reasons), I still have that original savings account that was set up when I was a child.

Many who want to be conservative in building and preserving their wealth accumulate large sums of cash, instead of placing their wealth in other asset vehicles such as stocks or real estate, out of fear of losing their money. But as I previous established, famed billionaire hedge fund manager Ray Dalio coined the term “Cash Is Trash.” Storing your money into something that is guaranteed to lose 2-4% in value every year, and in the case of 2021, 8-10% in value is a losing proposition. That is what inflation does to your stockpile of cash. (Read “How Inflation is Robbing You of Your Financial Freedom.”)

In the current higher inflation environment, people are uncertain about how that would affect the value of their assets. That uncertainty explains the volatility of the stock market and recent drops at the time of this writing. In order to curb inflation, central banks raise their interest rates to cool off the demand for goods and services that are driving their prices up. In response, stocks, bonds and more risky assets go down in price. (Read “Interest Rates, Inflation, War and Your Nest Egg”). The inevitable next question for the investor is, what is inflation going to do to the value of real estate?

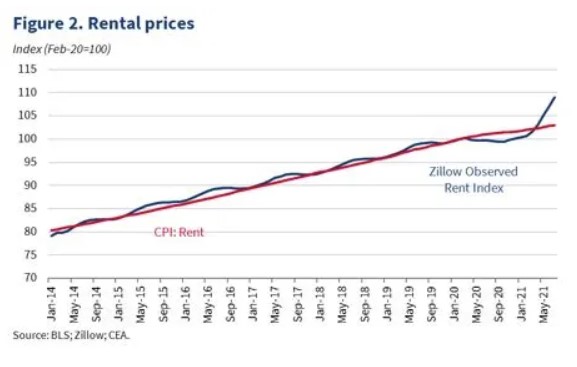

I previously established how inflation is calculated through the Consumer Price Index (CPI). The cost of housing is the largest component of inflation accounting for nearly a third of the overall CPI. This is based on a survey of rental prices for 43,000 housing units, which is then used to calculate the rise in rental prices as well as owners’ equivalent. However as previously established, since it is a survey, it was deemed to be underreported as the true costs are found to be higher than those reported in the survey.

So if inflation is determined largely by the cost of housing, and you own a property that houses people and families, then the value of that property you own should increase proportionately.

Scenario:

Let’s take an example using the current inflationary environment. Let’s assume hypothetical inflation rates for the next five years are as follows: 8% in year 1, 6% in year 2, 4% in year 3, and 2% in years 4 and 5.

Say that you bought a property for $4 million dollars and were planning on selling it in 5 years.

To buy the property, you finance it at 75%, therefore put down $1 million. Let us also say that you are using an interest only loan (no principal paydown), and you are not forcing appreciation on the property by making improvements and allowing it to appreciate organically based on inflation.

| Year | Property Value based on Inflation |

| Purchase | $4,000,000 |

| Year 1 | $4,320,000 |

| Year 2 | $4,579,200 |

| Year 3 | $4,716,576 |

| Year 4 | $4,810,907 |

| Sale at end of Year 5 | $4,907,125 |

As you can see, if property values were to keep pace with the hypothetical inflation rates, the property would have appreciated over $900,000. That means that your original $1 million down payment would almost double your money.

What about the value of the debt on the property, which is $3 million? Conversely, due to inflation, it decreases over time. At the time of sale of the property, that $3 million dollar loan will be worth the equivalent of $2,421,909. Does that mean that the actual loan payoff is that amount? No. You still will have to pay off the same $3 million in debt, however it will only be worth 80% of its value in year 5.

Recent spikes in CPI are in response to sharp rise in rental prices.

Courtesy of the White House

Therefore, by buying real estate, you are purchasing an asset that appreciates with inflation, using debt that depreciates and loses value over time. This is why real estate is an excellent hedge against inflation. Moreover, since the consumer price index is heavily correlated to the price of housing, then investing in multifamily real estate is the asset that would most closely keep pace with inflation.

And unlike other commercial real estate classes (e.g..: retail, hotels and vacation homes) since it addresses a fundamental human need, shelter, multifamily real estate remains a robust investment.

Do you want to learn more about how you can invest in multifamily real estate passively without being a landlord? Set up a time to talk personally with us.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.