How the Rich Invest

Dr. Joel J. Napeñas

8 minute read

Ultra high net worth individuals (UHNWIs) are those that have a net worth of over $30 million.

They have achieved that level through clear visions, education, extraordinary effort, taking calculated risks, not being afraid of failure, working with advisors, partners and mentors, and understanding the value of time knowing that there is no reason to solely trade time for money. In order to do so, they accumulated assets or built businesses that made their money work for them.

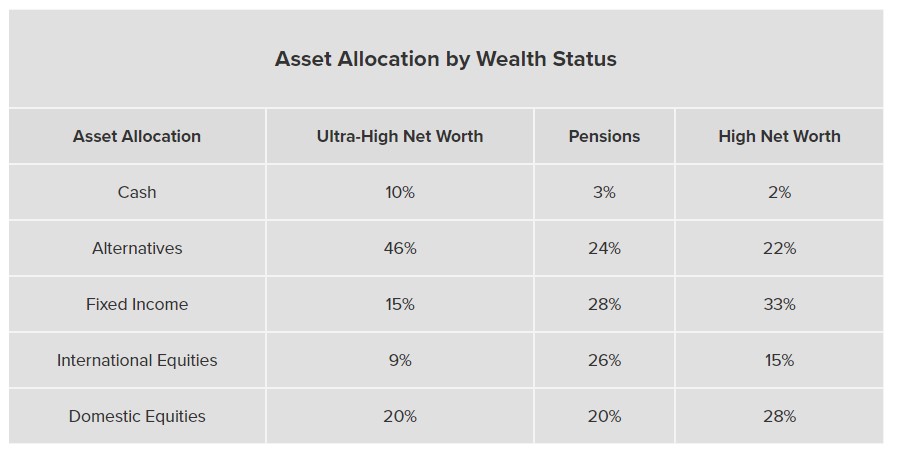

The average portfolio of the UHNWI differs dramatically from other types of investors. They have almost half of their money in alternative investments, while investing less than 30% in publicly traded (i.e.: stock market) domestic and international equities. By comparison, the average investor typically has 50% to 90% of their portfolio invested in stocks and bonds in the public market.

There are principles, both from a wealth growing and wealth preservation perspective that UHNWIs have that we can follow:

Cash Flow Strategy

How many times have we heard about the athlete, celebrity or lottery winner that earned millions of dollars only to find themself broke within a few years? These folks did not have a proper plan to manage their cash flow, depleting their entire financial windfall.

UHNWIs are not caught up in keeping up with the Jones, as they still have an eye on minimizing expenses and have a savings plan to set aside for cash to invest and accumulate assets that further build their wealth and generate passive income.

Those UHNWIs that you see with the lavish toys and fancy homes are only able to do so when they have enough income passively generated from their assets, and those items only comprise a small proportion of their cash flow and net worth. For example, Warren Buffett buying a private jet would be akin to the average person buying a Playstation or an iPhone. Unlike the average dentist who has to devote 6-10 years of their working life just to pay for their dream home, Bill Gates’ $130 million mansion is a mere fraction of his $106 billion net worth.

Invest for the Long Term

A vast majority of HNWIs have made their investment gains through a long-term buy and hold strategy. They establish long-term financial goals (i.e..: 10 years, 20 years, even the next generation) before making investment decisions, then create long-term investment strategies and stick to them. Instead of trying to keep up with what others’ are doing, or getting distracted by ‘shiny new objects’, or becoming scared of inevitable economic downturns, they stay the course. They keep their focus on funding long-term goals, while keeping near-term opportunities in mind as they go.

As Warren Buffet has said time and again, money is made in investments by investing, and by owning good companies (or assets) for long periods of time. This disciplined approach to investing helps the wealthy minimize their emotions and tune out market noise.

Asset Allocation

As part of their long-term investment strategy, the most important framework is their asset allocation plan. They know about all of the different types of assets and their characteristics such as whether they are there for growth versus income, the amount of risk, how they correlate with other assets, how volatile they are and how liquid they are (e.g.: how easily you can sell for cash).

Based on the characteristics of each asset, they strategically allocate the proper proportion of each asset in their portfolio. Depending on their level of risk, they would generally allocate more in less risky assets, and less on more risky assets. With the riskier assets, they know that not all of them will perform, that a proportion of them will lose, and that if one goes all the way to zero that it does not devastatingly impact their portfolio (e.g.: they do not put all of their liquid net worth into cryptocurrencies).

As part of the long term strategy, not only do they allocate, but they regularly monitor (either themself or with an advisor) and rebalance their portfolio. Therefore if there is one asset that outperforms, they would take the gains on that one and deploy it to the others’ following their asset allocation plan such that their portfolio does not skew too far towards one asset.

Some exceptions may be made, as if one is in the wealth building phase they would allow certain assets to appreciate disproportionately, whereas ones who are in the wealth preservation phase would be more prudent in rebalancing their portfolio and maintaining having a fixed proportion of less risky assets.

As part of the asset allocation plan is keeping a substantial amount of cash on hand. The majority of UHNWIs keep their liquidity high and a stockpile of cash so that they are in a position to act quickly when great opportunities present themselves. Not only do they make sure that they have access to cash before they need it by forming healthy savings habits, but they also make sure they have access to multiple sources of liquidity (e.g.: able to quickly sell or borrow against assets to redeploy into opportunities).

Invest in Tangible and Alternative Assets in the Private Market

The average person has their portfolio in stocks, bonds, mutual funds and exchange traded funds. While it is still a good place to put a portion of your money due to higher liquidity or smaller price for entry, it doesn’t mean that these types of investments are always the best.

The ultra wealthy gain a lot of their initial wealth from private businesses or property ownership, as angel investors, joint ventures or limited partners in private equities (e.g.: private funds or syndications).

UHNWIs understand the value of physical assets, and they allocate their money accordingly. Examples of physical assets include private and commercial real estate, land, gold, and even artwork. While it’s important to invest in these physical assets, they often scare away the average investor because of the lack of liquidity, inherent risks and the higher investment price point.

However, according to the ultra-wealthy, ownership in illiquid assets, especially ones that are uncorrelated with the market, is beneficial to any investment portfolio. Because of their illiquidity, these assets aren’t as susceptible to market swings, and they pay off over the long term.

Some of these tangible assets may be accessed through publicly traded securities in the public market (e.g.: Real Estate Investment Trusts (REITs), specific ETFs), and in crowdfunding platforms, however these more accessible and liquid versions are more susceptible to market swings.

The wealthy and UHNWIs understand that real wealth is generated in the private markets. Additionally, top endowments, such as those run at Yale and Stanford, use private equity investments to generate high returns and add to the funds’ diversification. For example, Yale’s endowment fund has implemented a strategy that includes uncorrelated physical assets, and it returned an overall average of 10.9% per year between June 2010 and June 2020 which is far better than the average investor.

Real estate (whether it is in the form of ownership, joint ventures, syndications) continues to be a popular, time tested and proven asset class in their portfolios to balance out the volatility of stocks.

Make Tax-Conscious Investment Choices

The saying goes that ‘It is Not How Much You Make that Matters, Rather it is How Much of it You get to Keep.’ More than half of UHNWIs say that, when making investment decisions, it is more important to minimize the impact of taxes than pursuing higher returns regardless of the tax consequences. Poor tax management and planning will add up over the long haul, and can easily cause you to sacrifice large portions of your gains and even generate losses in inopportune times once Uncle Sam ‘comes a knockin.’

Real estate has excellent tax benefits from both generating income and gains tax-free and for some, providing tax breaks when structured properly.

Not only do you need to understand the tax implications of your investments, but also the vehicles in which you make your investments in. Know the difference between taxable, tax-deferred (e.g.: 401ks) and tax-free accounts (e.g.: Roth IRAs). Peter Thiel, for instance, took great advantage of this by placing angel investments inside his Roth IRA. When he started two decades ago, the IRA was worth less than $2,000, but in 2019 was valued at $5 billion, all tax-free gains.

Use Credit as a Wealth Building Strategy

While we are told by Dave Ramsay and Suze Orman that all debt is bad, they are speaking to the majority of individuals who: use debt solely to fund their lifestyles; take on too much debt; use the wrong type of debt or; do not manage it properly. However, UHNWIs know how to use debt and access to credit to their financial advantage.

Even the most lucrative companies strategically carry some degree of debt. Apple, the most valuable company in the world with a market capitalization of $2.6 trillion (as of the time of this writing) carries $120 billion in debt.

Using debt and access to credit strategically is a most important means of accelerating wealth. In real estate for example, if you were to purchase a $1M property all in cash, and it generates $20,000 a year in cash flow, and sold it a few years later for $1.5M, you have a 2% annual return, and a 50% return on your investment on sale. Conversely, if you were to purchase the same property with 25% down (and 75% financed) and sell later, you get an 8% annual return and 200% return on your investment on sale.

Of course, one must use credit judiciously as it can be costly. Also, one must be prepared and able to cover the costs of servicing their debt in the event that things do not go according to plan.

Conclusion

Ultra high net worth individuals have built and preserved their immense wealth by following a set of fundamental principles. Whether you are just starting out or are already well established in your investing journey, you can learn and emulate these folks to build wealth and passive income for yourself.

If you want to talk about how you can build and preserve wealth and generate passive income like the ultra rich, set up a time to talk with me.