Investing in a Recession

Dr. Joel J. Napeñas

5 minute read

“Be FEARFUL when everyone is GREEDY and Be GREEDY when everyone is FEARFUL” – Warren Buffett

It is likely that we are currently in or heading towards a recession. A recession is a temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in the gross domestic product (GDP) in two successive quarters.

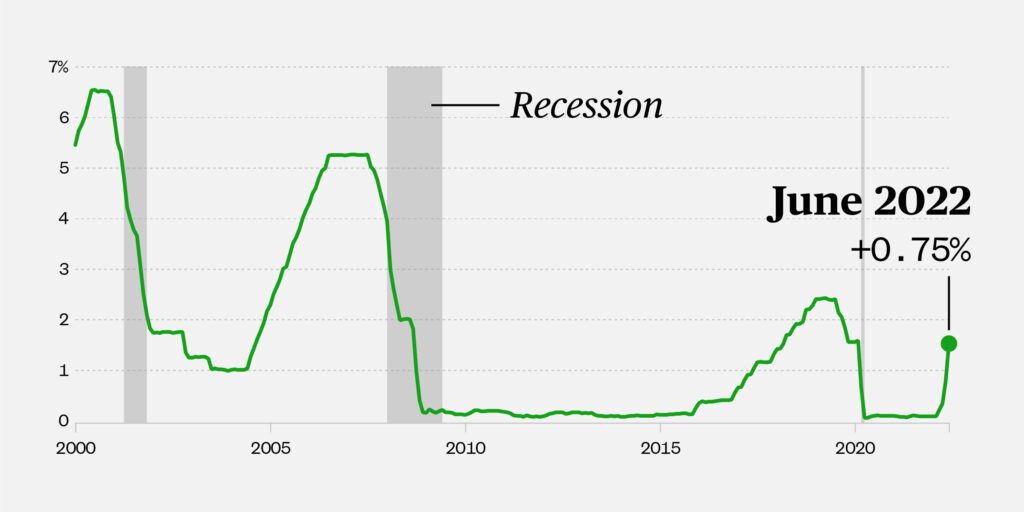

In recent years, the central banks of the world have created conditions which were favorable for economic activity, however when the economy is too hot then the demand for goods and services are too much leading to high inflation. To reverse this, central banks can either reduce the amount of money in the system (quantitative tightening), or increase the price of borrowing money (by increasing interest rates). They are effectively inducing a recession to curb inflation.

Folks I have spoken to have expressed weariness about investing in general during recessions, citing a number of reasons. First, they have seen the value of their portfolio of stocks, and other risk assets such as cryptocurrencies plummet. I previously outlined how increased interest rates favor the flight from risky assets, thereby decreasing their prices. (We personally have seen our own portfolio go down about 20-25% since the highs earlier in the year.) Also, the stock market does not like uncertainty, and with an economic slowdown, they are uncertain about underlying companies’ prospects for sustained earnings and growth. Therefore the market sells off these stocks, and further sales cause further decreases in their prices.

Individuals with holdings that have dropped do not want to sell for the purposes of redeploying their cash into other holdings, as it is psychologically interpreted as ‘losing money’. For example, one who saw their shares of Meta (formerly Facebook) drop 50% since the beginning of the year does not want to sell out as they are psychologically taking a ‘50% loss.’

Others, after seeing the price of assets tumble are generally fearful that the prices (and therefore the value) of everything are going to continue to tumble. So others’ simply keep cash and think that they can ‘time the market’ and buy at the bottom. However we have previously established that sitting on cash is a guaranteed losing proposition also. Also, the average investor (and even the professionals) cannot really forecast exactly when ‘the bottom’ is and by the time they have realized that it occurred, they missed out on opportunities and gains.

It is true that no investment is immune to the impact of a broader pullback caused by a recession. However there are fundamental things you can do to navigate and potentially thrive from investing during a recession.

Stay Invested

While having some ‘dry powder’ in the form of a stockpile of cash to use when the opportunity arises is wise, keeping everything in cash is a guaranteed loser also.

Yes, it hurts seeing the value of your portfolio go down from the amazing highs earlier this year. But we know that the economy works in cycles, and if you are investing for the long term then you know that your portfolio will also rebound accordingly.

Diversify

Don’t put your eggs in one basket. Invest in different asset classes, know the risks associated with each asset class and allocate appropriately based on risk. Meaning, allocate more to the assets that are less risky to you, and less to ones that are more risky.

When diversified, then all the individual components and holdings are not seen in isolation, rather they are merely pieces of a larger portfolio. Not everything you invest in will perform well, and most certainly some will lose. When you sell out of something that is underperforming, rather than looking at it as “selling at a loss” you are merely shifting your equity into something else you think will do better going forward, or adjusting your risk.

Also, have diversification within asset classes. If you have some stocks, have a diverse array of them. If you own or are invested in real estate, have a diversified portfolio of holdings in them This can be in the form of several properties you own, several syndications that you are passively invested in, different property types (such as multifamily, self storage, short term rentals or medical office buildings) or even different types of investment vehicles (e.g.: direct ownership, partnerships, syndications, crowdfunding, REITs).

Invest Based on Value, not Price

Just because it is cheap (and has gone down in price from where it used to be), it doesn’t mean that it is or will become more valuable in the future. That stock that went down in price may not recover from where it was prior to the recession.

Well how do you know what will become valuable again? You want to invest in an asset that has great fundamentals. Whether it is a stock, or a real estate property, you want to see:

– profitability (are they cash flowing in the form of a positive earnings for stocks or net operating income for real estate, and paying out dividends or distributions to their shareholders)?

– continued and sustained demand in a slower economic environment

– enough of a safety net (i.e.: cash reserves) to weather decreases in revenue and increases in expenses (e.g.: such as rising interest rates that increase the costs of servicing their debt)

– good management

This is the difference between investing versus speculating (or gambling).

Conclusion

Investing in general is scary in a recession. However, not investing is a guaranteed loser in a high inflationary environment.

Recessions are opportunities to make investments into assets at opportune prices. We are seeing this already in real estate, and if you are early in your stock investing journey the lower prices this year are working in your favor.

The adage has always been “Time IN THE MARKET is more important than TIMING THE MARKET.” Being in the market involves taking calculated risks. One can take more calculated risks and concentrate more when they are more knowledgeable about the assets they are investing in.

When one becomes more knowledgeable, takes calculated risks with their knowledge, and responsibly allocates their capital, they can invest comfortably and thrive in a recession.

Want to gain more knowledge about investing in real estate so you can invest confidently? Set up a time to chat with us.

This article is for information and education purposes only and is based on our opinions and observations. Before making decisions on investing, seek advice from a professional.

Dr. Napeñas, a practicing academic dental specialist in Oral Medicine, is founder and managing partner of 5DH Partners, a real estate investing firm that educates and helps dentists and other professionals generate passive income and build wealth through investing in real estate.

Want to learn more about investing in real estate without being a landlord?

Subscribe to our email newsletter here.

Set up a time to talk with us personally here.

Download a copy of our free e-book here to learn how dentists and other professionals can replace their income by passively investing in real estate.

Visit our Facebook and LinkedIn page, or join our newsletter mailing list for articles, updates and opportunities.